Are you thinking of acquiring cyber insurance for your business?

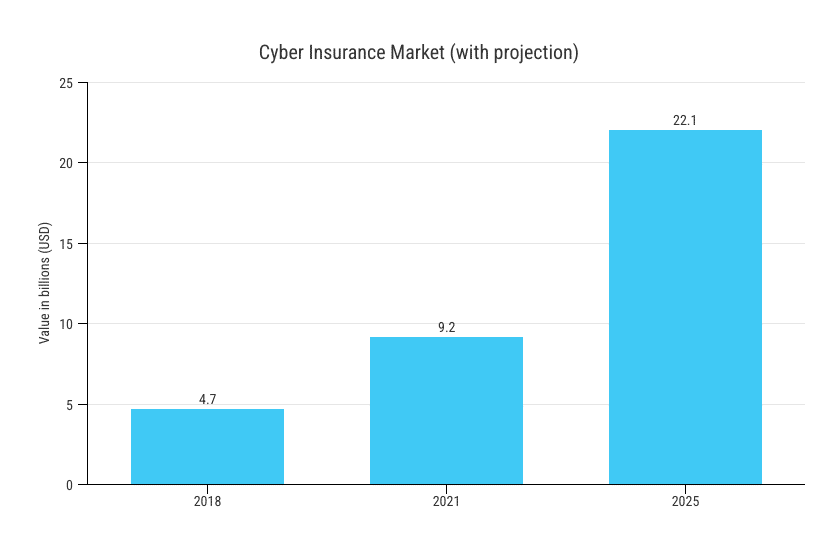

Cyber insurance has emerged as an important consideration for many Australian businesses. This relatively new but rapidly evolving form of insurance has quickly become a cornerstone of corporate risk management.

And it’s a market that’s projected to reach $22.1 Billion in value by 2025.

However, its adoption is not a one-size-fits-all solution. For some businesses, it’s a strategic choice to mitigate risk, while for others, alternative risk management strategies may be more appropriate.

The increase in cyber threats targeting companies of all sizes highlights the relevance of cyber insurance in the broader conversation about digital security.

But understanding the cyber insurance market, with its fluctuating premiums, diverse coverage options, and the dynamic nature of cyber threats, presents its own set of challenges. Making an informed decision about whether to invest in cyber insurance involves a careful assessment of your business’s specific risks and needs.

In this article, we’re going to dive into the world of cyber insurance. We’ll examine its role, the changing landscape of the market, and its potential impact on Australian businesses.

We aim to provide insights that help you weigh the benefits against the costs and complexities, ultimately guiding you towards a decision that aligns with your business’s unique risk profile and strategy.

The Current State of Cyber Insurance

Cyber Attacks Are Increasing & Targeting Companies of All Sizes

Cyber security threats are a universal challenge, sparing no sector or business size.

From small startups to large enterprises, companies are increasingly finding themselves in the crosshairs of cybercriminals.

The motives range from financial gain to industrial espionage, with the methods of attack constantly evolving.

Concerningly, during the 2022-2023 financial year, a majority of cybercrime reports in Australia originated from small businesses, highlighting vulnerability in this sector.

Additionally, the average self-reported cost of cybercrime to businesses has seen a substantial annual increase of 14% over the past two years, indicating a growing financial impact on companies.

This uptick in cyber incidents not only disrupts business operations but also causes significant financial and reputational damage.

The ubiquity of these threats underscores the growing interest in cyber insurance as a layer of financial protection.

Insurance Companies Face Challenges In Modeling and Pricing Cyber Risks

As demand for cyber insurance grows, insurers face significant challenges in accurately modelling and pricing these risks.

Unlike traditional forms of insurance, cyber risks are less predictable and rapidly evolving.

The lack of historical data on cyber incidents further complicates the process, leading to a dynamic and sometimes volatile cyber insurance market.

Key challenges include:

- Limited Data Availability: There is limited availability of detailed data on cyber incidents and their financial impacts. This scarcity hinders the development of accurate and reliable risk models.

- Rapidly Evolving Threat Landscape: Insurers must constantly adapt to new and emerging cyber risks, making traditional prediction methods less effective.

- Interconnected Risks: Complex digital interdependencies and shared IT infrastructures lead to aggregated risks that are hard to quantify, adding layers of complexity to risk assessment.

- Diverse Nature of Cyber Risks: The term ‘cyber risk’ covers a broad spectrum of threats with varied causes and impacts, complicating the pricing and coverage models.

- Need for Innovation: To keep pace with the changing landscape, insurers must employ innovative and flexible modelling techniques, embracing the multifaceted nature of cyber risks.

These factors combined make the cyber insurance market particularly challenging for insurers, who will need to continually adapt and innovate in their approach.

The Growing Need for Cyber Insurance Due to Client and Regulatory Requirements

Beyond the direct impact of cyber attacks, businesses are also navigating an environment where clients and regulators are increasingly mandating stronger cyber security measures.

Many businesses are finding that having cyber insurance is becoming a prerequisite for doing business, especially with large clients or in certain regulated industries.

Although cyber insurance is not mandatory in Australia at the time of writing, regulatory trends and client expectations are moving towards a more stringent approach to risk management.

This shift is elevating the importance of cyber insurance in business operations and shaping the policies and coverage that insurers offer.

Market Dynamics

Increasing Premiums & More Insurers in the Market

The cyber insurance market is experiencing a surge in premiums, partly due to increased awareness and demand for such policies.

This trend attracts more insurers to the market, each seeking to capitalise on this growing sector.

However, the influx of insurers doesn’t necessarily translate to lower prices for consumers. Instead, the heightened risk environment and the insurers’ need to balance their risk portfolios can contribute to the continued rise in premiums.

High Costs for Large Companies

Large companies often face particularly high cyber insurance costs. This is because they usually have more substantial assets at risk and potentially more significant liabilities in the event of a breach or cyber attack.

Additionally, as companies become more connected online, the impact of a cyber attack increases, which in turn raises costs.

Why Are Cyber Insurance Premiums Rising?

Several factors contribute to the rising costs of cyber insurance.

Firstly, the growing frequency and severity of cyberattacks leads to larger claims, pushing insurers to raise premiums.

Secondly, the evolving nature of cyber threats makes it challenging to predict and price risks accurately.

Additionally, as companies become more interconnected digitally, the potential impact of a cyber incident becomes more significant, further driving up costs.

Cyber Insurance is New & Evolving

Cyber insurance is a relatively new product in the insurance market, and its novelty contributes to the volatility in pricing and coverage options.

Unlike traditional insurance sectors with decades of historical data and established risk models, cyber insurance is still developing its benchmarks and standards.

The evolving nature of technology and cyber threats means that insurers must continually adapt their policies, leading to frequent changes in offerings and terms of cyber insurance products.

To Buy or Not to Buy

The Variability of Cyber Insurance Policies

Cyber insurance policies are not standardised and can vary greatly between insurers.

This non-uniformity means that coverage, exclusions, and terms differ significantly from one policy to another.

Businesses must carefully review and compare policies to ensure they align with their specific needs and vulnerabilities. The diverse nature of these policies reflects the broad spectrum of risks and necessitates a tailored approach to selecting the right insurance.

The Importance of Assessing Your Risk Posture

Before deciding on purchasing cyber insurance, a business must assess its risk posture.

This involves understanding the types of cyber threats it faces, the potential impact of these threats, and how well its existing cyber security measures can mitigate these risks.

A thorough risk assessment helps in determining the necessity and extent of insurance required. It will help ensure that the policy complements the company’s overall cyber risk management strategy.

Factors to Consider When Evaluating Cyber Insurance

When evaluating cyber insurance options, businesses should consider several key factors:

- Coverage Scope: Understand what types of incidents and damages the policy covers. This can include data breaches, ransomware attacks, business interruption, and more.

- Exclusions: Be aware of what is not covered under the policy. Some policies may exclude certain types of attacks or circumstances.

- Costs and Deductibles: Assess the policy’s premiums and deductibles concerning the coverage provided.

- Claims Process: Consider the insurer’s reputation and process in handling claims. A timely and supportive response in the event of a cyber incident is crucial.

- Policy Limits and Sublimits: Understand the maximum payout and any sub-limits that may apply to specific types of coverage.

- Compliance and Regulatory Requirements: Ensure the policy meets industry-specific regulatory requirements or client expectations.

- Carrier Expertise and Stability: Evaluate the insurer’s expertise in cyber risk and its financial stability.

Informed decision-making in this area requires a balance between the company’s internal risk management capabilities and the protection offered by cyber insurance.

Coverage Insights

What Does Cyber Insurance Include?

Cyber insurance policies typically cover a range of incidents and their resulting damages. Let’s take a look at some common inclusions.

Data Breach Costs

These are expenses related to a data breach, including notification costs, credit monitoring services for affected individuals, and forensic investigation.

Ransomware Attack

Coverage for ransom payments and related expenses in a ransomware attack.

Business Interruption Loss

Compensation for income lost due to a cyber incident that disrupts business operations.

Legal Fees and Settlements

Costs arising from legal actions due to a cyber event, including settlements and defence expenses.

These inclusions form the core of most cyber insurance policies, addressing the primary risks that businesses face in the digital realm.

Optional Coverages

In addition to standard coverages, cyber insurance policies may offer optional add-ons that can be critical for comprehensive protection.

- Cyber Extortion Coverage: Protection against costs associated with cyber extortion, such as threat investigation and negotiation expenses.

- Social Engineering Fraud Coverage: Safeguard against losses due to fraudulent electronic communications deceiving employees into transferring funds or sensitive information.

- Reputational Management Coverage: Support for PR and crisis management services to mitigate reputational damage following a cyber incident.

These optional coverages allow businesses to customise their policies according to their specific risk exposure and operational needs.

What Doesn’t Cyber Insurance Cover?

While cyber insurance provides valuable protection, it’s important to recognise its limitations:

- Policy Exclusions: Certain types of attacks or circumstances may be excluded from coverage, such as incidents resulting from employee misconduct or known vulnerabilities that were not fixed.

- Coverage Caps and Deductibles: Policies have limits on the amount they will pay out, deductibles apply before coverage kicks in.

- Indirect Losses: Some indirect costs of a cyber incident, like long-term brand damage or lost business opportunities, may not be covered.

By understanding these limits, your business can realistically assess how much protection its cyber insurance policy offers and identify any gaps that might require additional risk management strategies.

Get Your Free Essential Eight Cyber Security Report

Learn:

-

- The cyber security gaps costing you time and money.

- Practical steps to upgrade your security measures.

- The hidden risks of poor security protocols.

- How to bolster your cyber security and aid business growth.

The Role of Cyber Insurance Brokers

Why Should You Contact a Cyber Insurance Broker?

Contacting a broker can significantly streamline the process of acquiring cyber insurance.

Brokers have the advantage of access to multiple carriers and a variety of pricing options. This gives them a broad perspective of the market.

They’re also knowledgeable about the current dynamics, including which insurers are reliable in honouring claims and which may be less efficient.

Brokers can offer:

- Diverse Market Access: Their connections to multiple carriers allow them to present a range of options tailored to your specific needs.

- Insight into Insurer Reliability: Brokers can advise on insurers’ track records, such as their responsiveness to claims and legal disputes.

- Customised Solutions: With their market knowledge, brokers can help tailor policies to your business’s unique risk profile and requirements.

How Do You Select The Right Cyber Insurance Broker?

When choosing a broker, it’s crucial to consider their experience and market knowledge. Key criteria include:

- Experience With Cyber Security Policies: Ask the broker about the number of security policies they have placed in the past 12 months. A higher number indicates more experience and a better understanding of the market.

- Market Understanding: Select a broker who demonstrates a comprehensive understanding of market dynamics and can navigate these to your business’s advantage.

- Transparency and Reliability: Look for a broker with a reputation for transparency and reliability, particularly regarding their fees, commissions, and approach to client service.

- Compatibility with Your Business Needs: Ensure the broker understands your industry and specific business needs to provide the most relevant and effective coverage options.

A well-informed broker selection can be instrumental in cyber security insurance that offers real value and aligns closely with your business objectives.

Cyber Insurance is a Business Decision

Involve All Stakeholders in Decision Making

Deciding on cyber insurance is not just an IT issue; it’s a strategic business decision that affects every part of the organisation.

Therefore, involving all key stakeholders in the decision-making process is essential. This includes not only IT but also departments like finance, legal, operations, and sales.

By involving a broad range of perspectives, businesses can ensure that the decision on cyber insurance is well-rounded, aligning with the overall business strategy and goals.

This collaborative approach helps build consensus, fosters a more comprehensive understanding of the risks involved, and minimises the risk of surprises down the road.

Cyber Insurance Is a Business Enabler & Sales Tool

It’s a mistake to view cyber insurance as just a business cost. Instead, you should consider it as a business enabler.

Why?

Because in the current climate strong cyber security, underpinned by adequate insurance, can be a significant competitive advantage.

Businesses are starting to see this, particularly in sales and contract negotiations. Having cyber insurance can be a deciding factor for clients concerned about data security and risk management.

It reassures partners and customers that your business takes cyber risks seriously and has measures in place to protect against potential cyber incidents.

This aspect of cyber insurance can be instrumental in safeguarding the business and unlocking new opportunities and driving growth.

As such, cyber insurance should be considered an integral part of “business insurance”, securing the company’s digital assets and reputation just as traditional insurance protects physical assets.

The Case For Purchasing Cyber Insurance

Reduce Economic Damage Post-Attack

One of the main reasons to invest in cyber insurance is its role in reducing the economic impact of cyber attacks.

Cyber incidents can be financially crippling, with any number of costs, from data recovery to legal fees and compensation for affected customers.

Cyber insurance can help mitigate these costs, ensuring that a cyber attack doesn’t translate into a financial disaster for the business.

By covering various expenses related to cyber incidents, insurance can be a critical factor in maintaining financial stability post-attack.

Managing the Aftermath of a Cyber Incident

While preventing cyber attacks is ideal, it’s equally important to prepare for their potential occurrence. Cyber insurance plays a vital role in the post-incident phase, especially when an immediate response is crucial.

Cyber insurance often includes access to specialised support like breach coaches, who can guide your business through the incident response process.

These professionals have likely managed dozens, if not hundreds, of similar situations within a given year. This equips them with the expertise and knowledge to effectively navigate the aftermath of a cyber event.

Having immediate access to someone who can expertly handle the situation is a significant advantage. It allows for a more efficient and effective response, helping to mitigate potential missteps and addressing the unknowns that often accompany cyber incidents.

This expert assistance can be invaluable for minimising the damage, managing communication, and navigating legal requirements.

Ultimately, this can take some of the sting out of the loss and help accelerate your business’s recovery.

Don't miss out on our latest.

Join our subscribers and receive expert insights on cyber security and IT. Sign up now!

Improving Cyber Security Awareness and Preparedness

In addition to reducing financial loss and managing the aftermath of cyber incidents, purchasing cyber insurance can also drive deeper cyber security awareness and preparedness within your organisation.

Acquiring cyber insurance often involves a thorough assessment of the company’s cyber security practices and vulnerabilities.

This assessment can highlight areas for improvement and encourage investments in better cyber security measures.

As a result, your business doesn’t just gain financial protection but also strengthens its overall cyber security posture, reducing the likelihood of incidents and enhancing its resilience against potential threats.

Risk Assessment and Transfer

Conducting a Self-Assessment of Cyber Risks

The foundation of effective cyber insurance lies in a thorough self-assessment of your organisation’s cyber risk.

This process involves identifying and evaluating the various digital threats your business might face, such as data breaches, ransomware attacks, or phishing attempts.

A detailed risk assessment should consider not only the likelihood of these events but also their impact on your business.

Questions like “What would be the consequences of downtime?” or “How critical is the loss of sensitive information?” help in understanding the real-world implications of these risks.

This assessment enables your business to prioritise risks and understand what you need to protect against more urgently.

Aligning Insurance with Specific Risk Concerns

Once your business has a clear understanding of its cyber risk, the next step is to align its cyber insurance policy with the specific risks it wants to transfer.

This alignment means choosing a policy that covers the most critical and probable risks identified in the self-assessment.

For instance, if your business is particularly vulnerable to spear-phishing attacks, the policy should cover the costs associated with such incidents, including potential regulatory repercussions and data recovery efforts.

The goal is to balance your company’s internal cyber security controls with insurance coverage, ensuring that any gaps in protection are adequately addressed by the policy.

This tailored approach to cyber insurance ensures that the coverage is not only comprehensive but also cost-effective, providing protection where it’s needed most.

Arguments Against Cyber Insurance

Rising Costs, Reduced Coverage

One of the primary criticisms of cyber insurance is the increasing cost of premiums coupled with a perceived reduction in coverage.

According to Delinea’s 2023 State of Cyber Insurance report, 69% of companies have seen their premiums rise by 50% in the past 12 months.

As the market adjusts to the escalating numbers and severity of cyber threats, insurers are becoming more cautious, often leading to higher prices for less comprehensive coverage.

This trend raises concerns for businesses, especially those with limited budgets, as they may find themselves paying more for policies that don’t fully meet their needs or provide the expected level of protection.

Challenges in Making Successful Claims

Then there is what happens when you try to make a claim, an often complex and challenging process.

Insurers require substantial proof that your business had all the claimed controls in place and functioning correctly at the time of the incident.

This scrutiny can be rigorous, as insurers look closely for reasons to deny or reduce coverage. For instance, if a business claims to have Multi-Factor Authentication (MFA) on all administrative devices, they may be required to provide concrete evidence of this post-attack.

Failure to substantiate these claims can lead to reduced or denied payouts, adding stress and further financial burden to the recovery process.

Alternative Strategies for Small Businesses & Enterprises

If you’re a smaller business, investing in cyber insurance may not be the most strategic use of your limited resources.

Instead, allocating budgets towards implementing strong cyber security tools and controls can be a more effective way of mitigating risks.

This approach focuses on prevention, rather than post-incident recovery. And can be crucial for businesses that may not have the resilience to withstand the time and financial drain of recovering from a cyber attack.

By investing in strong cyber defences, these businesses may reduce their risk profile significantly, making the need for cyber insurance less critical.

Preparing for Reapplication & Audits

The Annual Cyber Insurance Review Process

The reapplication process for cyber insurance is an opportunity for your business to reevaluate and enhance its cyber security measures.

Unlike more static insurance types, cyber insurance demands an annual review due to the rapidly changing nature of cyber threats.

This process is akin to an audit, where insurers assess a company’s current cyber risk management practices against evolving best practices.

It’s a chance for your business to align its security measures with the latest industry standards and to initiate internal changes if there are gaps in its current approach.

Documentation & Evidence Collection

A crucial component of the reapplication process is the ability to provide documentation and evidence of the cyber security controls in place.

Your business may have adequate cyber security measures but lack the necessary documentation to prove it to insurers.

It’s essential to maintain detailed records of all cyber security policies, procedures, incident response plans, and any previous incidents and their management.

This documentation not only supports the reapplication process but also helps in the event of a claim, proving that your company has diligently implemented the security measures it claims.

Stay Ready

Rather than improving cyber security just for an audit, your business needs to maintain an audit-ready posture at all times.

This means having all controls, processes, and technologies not only implemented but also properly documented and ready to be reviewed.

If your business is always prepared for an audit, you’ll not only be compliant at the time of the insurance review, but you’ll also consistently maintain high standards of cyber security and have better defences.

Conclusion

Cyber insurance has increasingly become a major consideration regarding business risk management.

It can provide a safety net, and at the same time serve as a business enabler.

We’ve explored the complexities of choosing and managing cyber insurance, understanding market dynamics and policies, navigating the reapplication process, and preparing for audits.

However, cyber insurance isn’t a one-size-fits-all solution. It requires an understanding of your business’s specific risks, the ability to document and demonstrate strong cyber security practices, and a strategic approach to aligning coverage with your unique needs.

In some cases, it is better to focus your budget on prevention rather than acquiring insurance.

At Stanfield IT, we’re committed to helping businesses get cyber insurance-ready. As a trusted advisor in cyber security, we’re uniquely positioned to help your business qualify for and secure cyber insurance.

If your business seeks reliable protection, we offer the expertise and support you need. With our in-depth knowledge and experience, we can guide you through every step of the cyber insurance process, from assessing your current security posture to implementing the necessary measures to meet insurers’ requirements.

Contact us today to ensure your business is not only prepared for cyber threats but also optimally positioned to secure comprehensive cyber insurance coverage.

Some of our latest

Windows 10 End of Life (EOL) and What it Means

Microsoft has announced that October 14, 2025, will be the End of Life (EOL) date for Windows 10. Windows 10 EOL is set to affect all versions of Windows 10, including Home, Pro, Education, and Enterprise. Research from Lansweeper indicates that only 23.1% of...

ISO 27001 Certification in Australia: A Comprehensive Guide

Business data is like a treasure for cyber criminals. In fact, buried in almost every organisation's information assets are details worthy of holding ransom. So, how do you protect it? With ISO 27001 certification. ISO 270001 is more than just a standard industry...

Cyber Hygiene For Business: What You Need To Know

Implementing cyber hygiene practices is one of the most effective ways to protect your business from cybersecurity risks. As a business owner, the security of your company's data is paramount. With the prevalence of cyber-attacks in the modern world, it’s increasingly...